How Companies Win the Mergers and Acquisitions Game: A Comprehensive Guide

5 out of 5

| Language | : | English |

| File size | : | 41922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 410 pages |

Mergers and acquisitions (M&A) are powerful tools for corporate growth and transformation. When executed successfully, they can unlock significant value for shareholders, customers, and employees alike. However, the M&A landscape is fraught with risks and challenges, and only a small percentage of deals ultimately achieve their intended objectives.

In this comprehensive guide, we will explore the key strategies and best practices for successful mergers and acquisitions. We will cover every stage of the M&A process, from deal sourcing and due diligence to integration and post-merger management. By following the advice in this guide, companies can increase their chances of success and reap the rewards of strategic partnerships.

Deal Sourcing and Evaluation

The first step in any M&A transaction is to identify potential targets. This can be a time-consuming and complex process, but it is essential to take the time to find the right partner.

There are a number of factors to consider when evaluating potential targets, including:

- Strategic fit: Does the target company fit with your overall business strategy?

- Financial performance: Is the target company financially sound?

- Cultural fit: Do the cultures of the two companies align?

- Management team: Is the target company's management team strong and experienced?

- Regulatory environment: Are there any regulatory hurdles that could prevent the transaction from being completed?

Once you have identified a potential target, the next step is to conduct due diligence. Due diligence is a thorough investigation of the target company's financial, legal, and operational condition. The goal of due diligence is to uncover any potential risks or red flags that could jeopardize the transaction.

Negotiation and Deal Structuring

Once you have completed due diligence and are satisfied with the results, the next step is to negotiate the terms of the transaction. This is a complex process that can involve a number of different issues, including price, payment terms, and the structure of the deal.

It is important to have experienced legal and financial advisors on your side during the negotiation process. These advisors can help you to ensure that the terms of the transaction are fair and protect your interests.

Integration Planning and Execution

Once the transaction has been agreed upon, the next step is to plan and execute the integration of the two companies. This is a critical phase of the M&A process, and it is essential to get it right.

There are a number of factors to consider when planning for integration, including:

- Organizational structure: How will the two companies be organized after the merger?

- Culture: How will the cultures of the two companies be merged?

- Operations: How will the operations of the two companies be integrated?

- Technology: How will the technology systems of the two companies be integrated?

- Human resources: How will the human resources of the two companies be integrated?

It is important to develop a detailed integration plan that addresses all of these factors. The plan should be communicated to all employees of both companies, and it should be followed closely throughout the integration process.

Post-Merger Management

The integration process can take several months or even years to complete. During this time, it is important to carefully manage the newly merged company. This includes:

- Monitoring financial performance: Track the financial performance of the merged company to ensure that it is meeting expectations.

- Managing employee morale: Keep employees informed about the integration process and address any concerns they may have.

- Integrating the different cultures: Foster a positive and inclusive culture that embraces the best of both companies.

- Adapting to the changing market: Monitor the market and make adjustments to the business strategy as needed.

By following the advice in this guide, companies can increase their chances of success in the mergers and acquisitions game. With careful planning and execution, M&A can be a powerful tool for corporate growth and transformation.

Mergers and acquisitions are complex and challenging transactions, but they can also be incredibly rewarding. By following the strategies and best practices outlined in this guide, companies can increase their chances of success and reap the rewards of strategic partnerships.

If you are considering a merger or acquisition, we encourage you to seek professional advice from experienced legal and financial advisors. These advisors can help you to navigate the complex M&A process and maximize the chances of a successful transaction.

5 out of 5

| Language | : | English |

| File size | : | 41922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 410 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Jess E Owen

Jess E Owen Kiana Danial

Kiana Danial Kyle Chayka

Kyle Chayka Rie Sheridan Rose

Rie Sheridan Rose Tina Payne Bryson

Tina Payne Bryson Meredith Talusan

Meredith Talusan Jennifer Senior

Jennifer Senior Jim Shooter

Jim Shooter Jennifer R Lee

Jennifer R Lee Jessica Mayer Koren

Jessica Mayer Koren Patrick Carnes

Patrick Carnes Jerel Law

Jerel Law Jessica Berger Gross

Jessica Berger Gross Jerry Robeson

Jerry Robeson Sunny Seki

Sunny Seki Jenna Helland

Jenna Helland Scott Hawthorn

Scott Hawthorn Lonely Planet Kids

Lonely Planet Kids Stephen Birmingham

Stephen Birmingham Jenny Henderson

Jenny Henderson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Dylan HayesFollow ·9.8k

Dylan HayesFollow ·9.8k Colby CoxFollow ·4.7k

Colby CoxFollow ·4.7k Vincent MitchellFollow ·13.7k

Vincent MitchellFollow ·13.7k Bradley DixonFollow ·10.7k

Bradley DixonFollow ·10.7k DeShawn PowellFollow ·8.3k

DeShawn PowellFollow ·8.3k Gilbert CoxFollow ·8.5k

Gilbert CoxFollow ·8.5k Abe MitchellFollow ·14.7k

Abe MitchellFollow ·14.7k Chance FosterFollow ·13.3k

Chance FosterFollow ·13.3k

Jeremy Mitchell

Jeremy MitchellUnveiling the Truth: The Captivating Saga of The Elephant...

Embark on a poignant journey through the...

Marvin Hayes

Marvin HayesThe Day The World Came To Town: A Heartwarming Tale of a...

In the quaint...

Hugh Bell

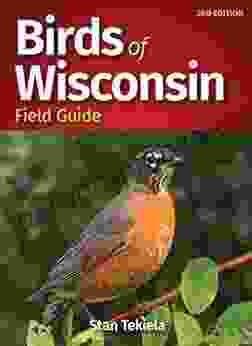

Hugh BellExplore the Avian Treasures of Wisconsin: A Review of...

Unveiling the Secrets of...

5 out of 5

| Language | : | English |

| File size | : | 41922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 410 pages |